Managing technology costs is a challenge for many businesses. Whether it’s staffing, software, hardware, facilities, telecom, or outside service expenses, understanding the different cost models is crucial to establishing and managing an effective budget. Often, this involves having a discussion with the CFO about your company’s current posture and policies toward CAPEX and OPEX allocations.

Capital expenditures (CAPEX) are upfront investments that will be used for some time to come, while operating expenses (OPEX) are ongoing expenses necessary for day-to-day operations. In other words, building a new on-site server room would fall under a CAPEX expenditure, while ongoing maintenance costs for that room would represent an OPEX expense. When it comes to managing technology costs, there are pros and cons to either approach, and businesses must take the time to understand them and set company-wide policies that will help IT avoid technical debt — sunk costs related to undercapitalized technology. Company policies for CAPEX and OPEX include rules such as any purchase less than $5,000 will be treated as OPEX, or servers will have a 60-month “book” life. These policies will have an impact on your IT budget.

Understanding technology costs

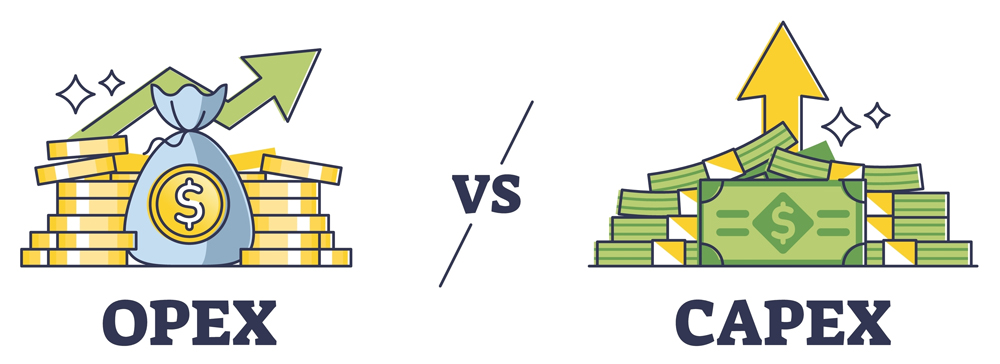

Understanding your technology costs is a critical first step in effectively managing them. Take inventory of your tech expenses and examine them from three critical standpoints: hardware, software, and services. The following table is an example of an IT budget dashboard that accounts for the entire IT budget:

This allows you not only to consider what technologies you currently utilize, but also to understand what your current budget allocation looks like, helping you identify areas where you might be over or underspending.

During this assessment, it’s also important to consider the hierarchy of your investments. Prioritize them based on fixed vs. variable, need vs. want, and present vs. future. For example, investing in software to save your team time and increase productivity may be a higher priority than upgrading hardware that’s still reliably functional. Identifying priorities helps set the stage for future CAPEX vs. OPEX allocation discussions.

Ideally, taking stock of current tech investments enables you to envision allocating your budget in a way that best supports top-level business goals and long-term objectives.

CAPEX considerations

Though technology investments have traditionally fallen under CAPEX, today there are ways to push CAPEX costs to OPEX. But just because you can, that doesn’t necessarily mean you should. The tech itself, and your forward-looking vision for it, should inform your decision.

From an accounting standpoint, one important consideration in CAPEX allocation is useful life vs. book life. While useful life refers to the length of time an asset can be used before the technology becomes obsolete, book life is the period over which an asset’s cost is being depreciated for accounting purposes. For example, a PC might have a book life of 36 months, but the asset might be useful for four or five years. In some situations, eating the upfront CAPEX cost of a necessary upgrade is more advantageous than trying to amortize that cost over a book life longer than the tech’s useful life. Why get stuck paying for already obsolete technology?

Another benefit of CAPEX for tech investments is that businesses own these assets outright and have control over their use. While cost is sometimes a barrier, companies looking to make strategic investments may choose CAPEX as a way to burn cash on hand for the sake of long-term ROI.

Pushing costs to OPEX

As mentioned, there is more opportunity today for businesses to forgo the CAPEX cost burden and instead roll tech expenses into an OPEX model. But again, it’s important to consider your broader business goals before opting to amortize costs.

For cash-conscious companies, pushing technology costs into an OPEX model allows them to avoid larger, and often prohibitive, CAPEX investments. This not only helps with cash flow management but also makes it easier to budget for ongoing expenses. One interesting side note is the impact of the cloud on IT finance. Cloud is an OPEX spend, where you pay for what you use.

Additionally, OPEX models can provide significant flexibility, as businesses can adjust their technology usage and expenses as needed. This is particularly true for SaaS subscriptions, equipment leases, and service-level agreements (SLAs) — all of which lend themselves naturally to OPEX costing.

The drawback to OPEX? In the end, costs add up and may even become more expensive than an upfront CAPEX investment. Additionally, businesses may get locked into long-term contracts or agreements that make it difficult to switch to new technologies without incurring further costs.

Thoughtfully allocating spend

A business’s approach to its tech budget should focus on the long term. There is no one-size-fits-all strategy for CAPEX or OPEX allocation. Ultimately, it’s about creating a budget that responsibly bears the cost of critical tech investments and getting the most out of those investments across their service life.

Learn more about responsible tech budgeting at windzr.com.